Featured

Table of Contents

- – The Expanding Need for Financial Debt Alleviat...

- – Comprehending How Debt Forgiveness In Fact Fun...

- – Insolvency Counseling: Required Actions and Re...

- – Comparing Nonprofit Providers: What Differenti...

- – Debt Management Plans: The Middle Ground Option

- – Warning and Indication in Debt Relief

- – Tax Ramifications of Forgiven Debt

- – Making the Decision: Which Path Onward

- – The Path Toward Financial Healing

Financial challenge hardly ever introduces itself politely. One unanticipated medical costs, an abrupt task loss, or simply the progressive accumulation of high-interest bank card equilibriums can change manageable monthly settlements into an overwhelming worry. For millions of Americans lugging five-figure financial obligation lots, recognizing the distinctions between financial obligation mercy programs, personal bankruptcy counseling, and financial obligation monitoring strategies has actually become crucial understanding.

The Expanding Need for Financial Debt Alleviation Solutions

Customer financial debt levels proceed climbing throughout the USA, pushing even more families towards looking for expert assistance. The financial debt alleviation market has increased correspondingly, developing a complex industry where differentiating legit assistance from potentially hazardous services requires cautious evaluation.

Not-for-profit credit rating therapy companies have become a more secure choice to for-profit financial debt negotiation business, which consumer protection organizations regularly caution against. These nonprofits typically run under government and state standards requiring transparent fee frameworks, complimentary first appointments, and educational parts along with direct treatment solutions.

Organizations approved by the united state Department of Justice to provide credit therapy need to satisfy specific requirements, using consumers some assurance of legitimacy. Names like Finance International, InCharge Debt Solutions, and American Pacific Financial Services Corp (APFSC) represent developed players in this space, each offering variations on core financial debt relief services while preserving nonprofit condition.

Comprehending How Debt Forgiveness In Fact Functions

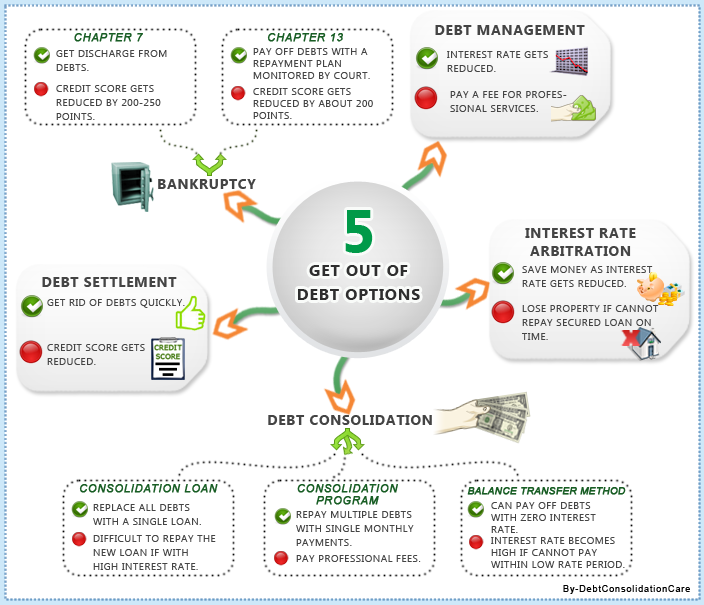

Debt mercy, often called financial debt negotiation or "" less than complete balance"" programs, operates on a simple facility: creditors approve payment of much less than the complete amount owed, forgiving the continuing to be equilibrium. This technique differs essentially from debt monitoring strategies, where consumers settle their complete principal with reduced rates of interest.

The procedure usually needs accounts to be dramatically delinquent, generally 120 to 180 days overdue. At this stage, lenders have actually frequently billed off the financial debt and may choose bargained settlements over pursuing prolonged collection efforts or running the risk of full loss through consumer personal bankruptcy filings.

Certified customers function with therapy agencies to discuss reduced balances, then develop structured repayment plans spanning about 36 months. Once all concurred settlements total, lenders forgive continuing to be quantities. Some firms, including APFSC and InCharge, deal certain charge card debt mercy programs structured around these timelines.

Nonetheless, financial debt forgiveness brings important considerations. Worked out amounts commonly influence credit report, though for customers currently in default, this result may show marginal contrasted to ongoing non-payment damage. In addition, forgiven financial debt usually makes up taxed earnings under federal guidelines, possibly developing unforeseen tax obligations.

Insolvency Counseling: Required Actions and Readily Available Assistance

When financial obligation situations exceed what negotiation or management can deal with, personal bankruptcy gives lawful security and potential financial debt discharge. Federal law mandates details counseling requirements for any individual seeking this option, developing opportunities for both education and treatment.

Pre-filing credit report counseling should occur prior to sending bankruptcy documentation. These sessions evaluate revenue, financial obligations, and expenses while discovering alternatives to filing. Lots of customers uncover with this procedure that financial debt management plans or mercy programs might fix their scenarios without personal bankruptcy's long-lasting credit scores implications.

Post-filing borrower education, required before discharge, concentrates on budgeting abilities, credit score rebuilding techniques, and monetary monitoring methods. Both training courses typically take 60 to 90 minutes and can be finished online, by telephone, or face to face with authorized carriers.

Organizations like APFSC, InCharge, and countless NFCC member companies give these needed programs, normally billing small fees around $20 per session with waivers available for qualifying individuals. Conclusion produces certificates required for court filings.

Comparing Nonprofit Providers: What Differentiates Quality Solutions

Not all not-for-profit credit history therapy companies offer the same solutions or maintain equal connections with financial institutions. Reviewing companies needs analyzing a number of factors beyond basic not-for-profit standing.

Lender relationships matter dramatically. Agencies preserving partnerships with major financial institutions and charge card issuers can often discuss much more favorable terms than more recent or smaller sized companies. Developed nonprofits commonly deal with organizations like Chase, Citi, Capital One, Discover, and Bank of America, promoting smoother registration and better passion rate reductions.

Solution breadth varies considerably. Some companies focus specifically on debt administration strategies, while others provide thorough options including financial obligation forgiveness programs, personal bankruptcy counseling, real estate therapy, and specialized solutions for unique scenarios like divorce-related debt or medical expense arrangements.

The National Foundation for Debt Therapy offers as an umbrella company attaching consumers with accredited counselors across the country, offering one method for locating respectable regional carriers. HUD-approved real estate counseling agencies, including Credit.org with over 50 years of operation, offer extra confirmation of business legitimacy.

Certification via organizations like the Council on Accreditation or membership in the Financial Therapy Association of America shows adherence to industry standards. Customer reviews with platforms like Trustpilot, Bbb ratings, and Google evaluations provide real-world responses regarding service quality and results.

Debt Management Plans: The Middle Ground Option

Between financial obligation mercy and bankruptcy sits the debt monitoring plan, commonly standing for one of the most proper option for consumers that can keep organized repayments but deal with high rate of interest.

Via these plans, nonprofit companies work out with creditors to decrease passion rates, usually dropping them to solitary numbers from the 20-plus percent typical on credit history cards. Late fees and over-limit charges commonly obtain forgoed for enrolled accounts. Customers make solitary regular monthly repayments to the therapy agency, which disperses funds to financial institutions according to worked out terms.

Plans generally cover 3 to five years, with typical conclusion around 40 months according to industry data. Unlike debt mercy, customers repay their full principal, maintaining credit scores more successfully while still accomplishing meaningful savings through interest decrease.

Certification calls for showing capability to keep settlements throughout the strategy term. Accounts need to normally be closed upon registration, protecting against added billing while solving existing balances. This compromise in between credit access and debt resolution represents a key factor to consider for consumers weighing alternatives.

Warning and Indication in Debt Relief

The financial debt alleviation market however brings in predative drivers along with genuine nonprofits. Recognizing caution signs aids customers avoid solutions that might aggravate their circumstances.

Upfront charges before solutions render stand for a considerable red flag. Federal guidelines restrict financial debt settlement companies from billing charges up until effectively discussing settlements and obtaining at the very least one settlement towards the resolved amount. Firms asking for considerable repayments before showing results likely break these securities.

Guarantees of particular savings percents or assures to get rid of financial debt entirely should set off hesitation. Reputable counselors recognize that financial institution engagement varies and outcomes depend upon specific scenarios. No agency can guarantee creditor teamwork or certain settlement quantities.

Guidance to stop paying financial institutions while building up funds for negotiation develops substantial danger. This strategy, common among for-profit settlement firms, generates added late costs, rate of interest charges, and possible legal actions while harming credit rating better. Nonprofit companies typically inhibit this method.

Pressure methods, limited-time deals, or reluctance to give written details about charges and services suggest bothersome drivers. Trusted nonprofits provide thorough explanations, answer inquiries patiently, and enable consumers time to make educated choices.

Tax Ramifications of Forgiven Debt

Consumers going after debt forgiveness must comprehend possible tax repercussions. Under government tax obligation regulation, forgiven financial debt amounts going beyond $600 normally make up gross income. Creditors report these total up to the IRS using Kind 1099-C, and customers should report them on yearly income tax return.

For someone resolving $30,000 in the red for $15,000, the forgiven $15,000 can increase gross income considerably, potentially creating unanticipated tax liability. Consulting with tax obligation experts before registering in forgiveness programs helps consumers get ready for these commitments.

Certain exemptions exist, including insolvency provisions for customers whose responsibilities exceeded possessions at the time of mercy. Bankruptcy-discharged financial debt likewise obtains different therapy. These complexities enhance the value of specialist advice throughout the financial debt resolution procedure.

Making the Decision: Which Path Onward

Choosing between financial debt forgiveness, financial obligation monitoring plans, and insolvency requires straightforward assessment of private situations. Several questions guide this assessment.

Can you preserve structured repayments over 3 to five years? If of course, debt management plans preserve credit rating while lowering prices. If settlement capacity is significantly restricted, mercy programs or personal bankruptcy may show better.

Exactly how delinquent are your accounts? Financial debt forgiveness generally needs significant misbehavior, making it unsuitable for customers current on settlements who merely desire alleviation from high rate of interest.

What are your lasting monetary goals? Insolvency stays on credit scores records for seven to 10 years, while worked out accounts impact ratings for much shorter durations. Customers intending major acquisitions like homes within a number of years may choose choices with less lasting credit score results.

The majority of not-for-profit agencies provide free first consultations, enabling exploration of choices without commitment. Benefiting from these sessions with multiple service providers assists customers comprehend offered paths and make informed options regarding which organization and program best fits their demands.

The Path Toward Financial Healing

Overwhelming financial debt develops stress prolonging far beyond economic issues, impacting health, partnerships, and high quality of life. Understanding readily available options represents the crucial primary step towards resolution and eventual recovery.

Not-for-profit credit score therapy firms provide organized pathways towards debt relief, whether through management plans reducing passion while maintaining full repayment, mercy programs resolving financial obligations for much less than owed, or insolvency therapy assisting customers via lawful discharge procedures.

Success requires sincere financial assessment, cautious supplier analysis, and commitment to whatever resolution strategy emerges. The journey from financial dilemma to security takes some time, yet countless customers have browsed it efficiently with proper expert support.

Housing Counseling Services : APFSC Guidance for HomeownershipFor those presently having a hard time under financial debt burdens, resources exist to help. The challenge lies not in locating assistance yet in finding the appropriate support, correctly matched to individual scenarios and objectives. That matching process, embarked on thoughtfully with details gathered from multiple sources, creates the structure for lasting monetary healing.

Table of Contents

- – The Expanding Need for Financial Debt Alleviat...

- – Comprehending How Debt Forgiveness In Fact Fun...

- – Insolvency Counseling: Required Actions and Re...

- – Comparing Nonprofit Providers: What Differenti...

- – Debt Management Plans: The Middle Ground Option

- – Warning and Indication in Debt Relief

- – Tax Ramifications of Forgiven Debt

- – Making the Decision: Which Path Onward

- – The Path Toward Financial Healing

Latest Posts

Non-Profit How Housing Counselors Work with Legal Aid When You’re at Risk of Eviction Options Compared Fundamentals Explained

About What Legislation Says When Receiving Financial counseling for veterans in California facing high rent and everyday living costs

The Only Guide for Restoring Personal Credit Score the Right Way

More

Latest Posts

Non-Profit How Housing Counselors Work with Legal Aid When You’re at Risk of Eviction Options Compared Fundamentals Explained

The Only Guide for Restoring Personal Credit Score the Right Way